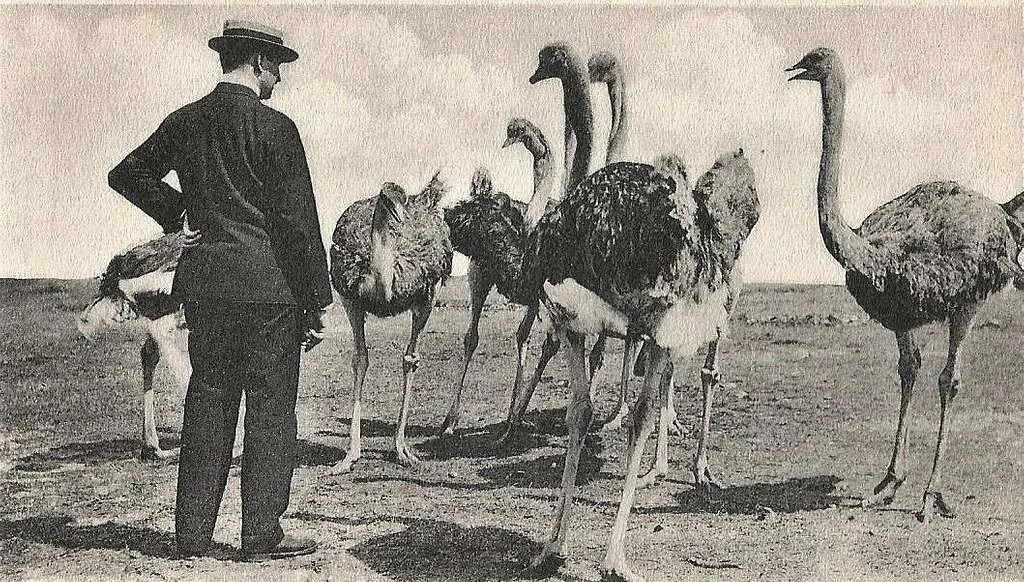

To protect Abrams and Bradley tanks from helicopters armed with antitank missiles, the US Army commissioned a new mobile anti-aircraft system. Ford Aerospace won the contract and, in 1981 began producing the M247 Sergeant York.

The M247’s dud automatic targeting system was the cause of many embarrassments; it struggled to distinguish helicopters from trees and often locked on random ground-based objects. In one notorious instance, it targeted a nearby latrine’s exhaust fan and even worse, during a high-profile demonstration for senior military officials and VIPs the M247 locked on to spectator stands, resulting in chaos as people scrambled to get out of its way.

Despite problems, the Army persisted and continued to pump money, convinced that the project could be salvaged. Two billion dollars later, after having produced only a few dozen units, none of them capable of distinguishing between a toilet vent fan and a jet, they finally gave up. By then advances in enemy weaponry had made the system obsolete anyways.

This story illustrates sunk cost fallacy, the tendency to continue investing in a failing project just because we’ve already spent so much time, money and effort on it, even when cutting loses would be the wiser choice.

Sunk cost fallacy is a cognitive bias, which means that we don’t notice us falling into it and hence decisions feel rational in that moment. We suffer from it because our brains are wired to value past investments. It also stems from emotional attachment that comes with time and effort spent and our desire to justify past decisions, backing out means admitting we were wrong making us seem incompetent. In organizations leaders often continue funding struggling projects to save face rather than admit mistakes.

There are some techniques to avoid falling into a sunk cost thinking.

Future Versus Past test. Ask if I hadn’t invested anything yet, would I still make this investment? If the answer if no, then it’s time to cut your losses and walk away.

Setting milestones and exit criterion. Before starting the project set up clear milestones with deliverables and exit criterion.

Reframing losses. Reframing investments as learning helps reduce the emotional burden to make the more rational decision to pause. Labeling new projects ‘pilots’ makes it easier to shut it down.

Reliance offers a modern corporate example of avoiding sunk cost thinking, In 2018 the company launched Reliance Health Insurance, but when the business failed to gain sufficient traction, they shuttered it within two years instead of pouring more money into a struggling business. The company’s philosophy of ‘disrupt, not create’ guides decisions, if they are unable to disrupt a business, they exit quickly. Whether its disinvestment of shale gas assets or writing off a $200 million investment for Dunzo, Reliance avoids sunk cost thinking with their focus on long-term vision, ruthless portfolio management against specific goals and focus on future cash flow.

The M247 Sergent York saga holds lessons for organizations and individuals. While there’s no doubt that persistence yields success, but in the face of change if you continue defending yesterday’s decisions you will end up sacrificing future opportunities. Paradoxical as it may sound, agility and persistence need to coexist, success lies in having the discipline to walk away when reality demands it.

First published here in BW BusinessWorld

Leave a comment